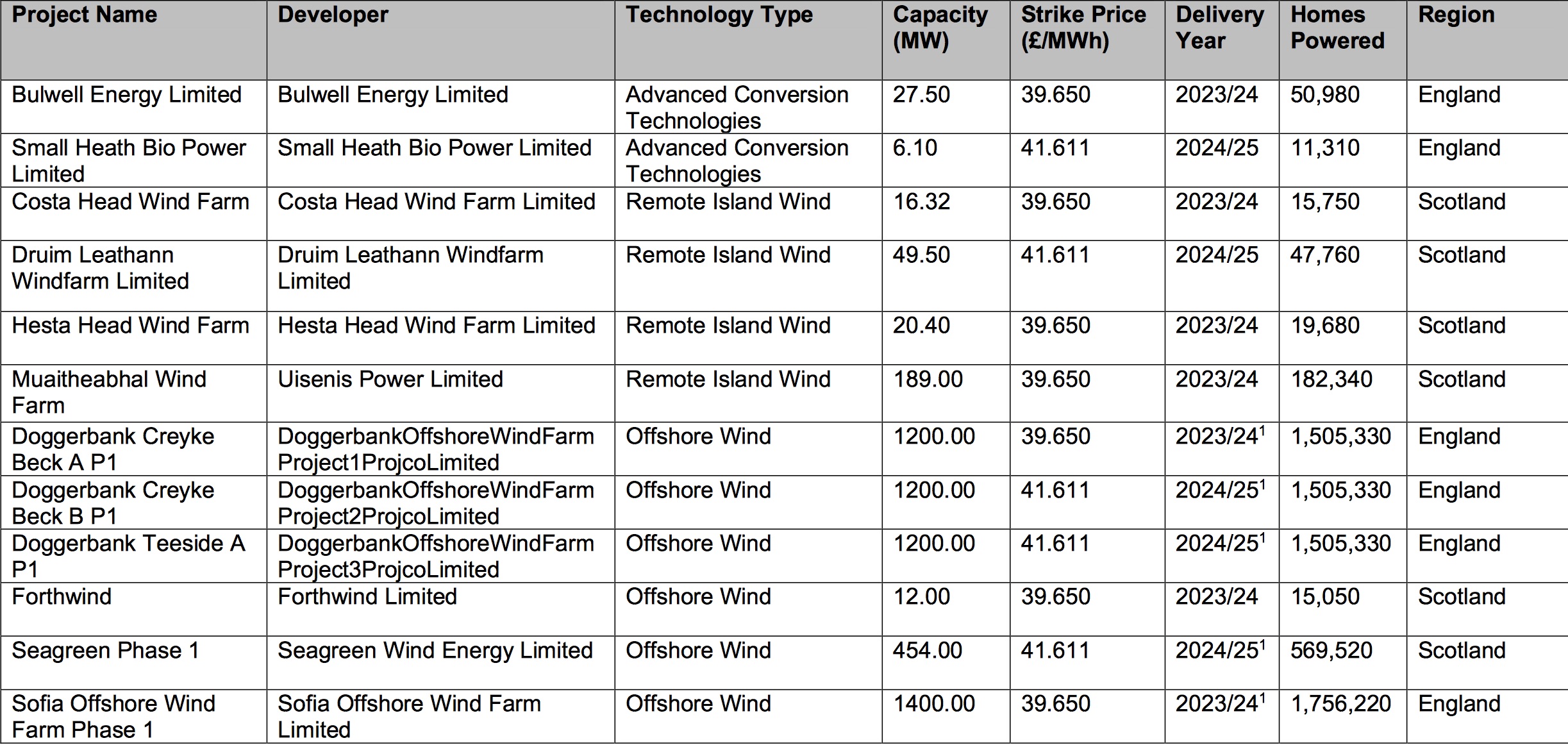

The upcoming round of offshore wind farms will be delivered at prices of £39.65-£41.61 per megawatt hour, for windfarms delivered by 2025. The results of the governent’s latest Contracts for Difference auction showed a drop from the previous auction two years ago, when prices were £57.50-£74.75//MWh. The speed at which prices have falllen are a dramatic contrast to industry and government targets set at the time of the first auction, seen at the time as extremely ambitious at the time, to achieve a price of £100/MWh by 2020.

Dr Jonathan Marshall, Head of Analysis at the Energy and Climate Intelligence Unit (ECIU), said: “At just a third of the price of contracts signed just four years ago, these latest deals highlight how renewables are blowing the competition out of the water. Signing deals at rock-bottom prices mean that low-cost, low-carbon electricity is being locked in for the future, easing household budgets and ensuring that costs faced by British businesses fall.

“In fact, costs have now fallen so rapidly that it is a government-imposed cap that is limiting the amount of capacity installed. Every passing auction shocks onlookers with record low costs. Now questions may start to be asked if waiting two years between auctions is in the best interest of British homes and businesses.”

Meanwhile, however, uncertainty remains over the outcome of the auction as it awaits the outcome of a judicial review. Banks Renewables initiated the review, saying the auction discriminates in favour of offshore wind at the expense of onshore wind and other renewable energy technologies. Banks says that discrimination, ”is against the public interest, prevents consumers from benefiting from the lower energy prices that would result from their inclusion and, from a legal perspective, does not comply with either EU or UK law.” However, RenewableUK noted that the low prices achieved for offshore wind in the current auction make it the cheapest generation option in the UK.

Richard Dunkley, managing director at Banks Renewables, said: “We have consistently expressed the view for many years that, as the most cost-effective method of low carbon electricity generation available, consented onshore wind farms should be included within the CfD auction process, and we have been in discussion with the UK government over this matter for several months.”

Further reading

Search and sort data on UK power assets via New Power’s online Database. Free access for New Power Report subscribers

At least 7GW of new offshore wind in prospect as Crown Estate opens seabed leasing Round 4

Banks Renewables judicial review puts a freeze on CfD auction

Ørsted raises renewable generation focus as it divests customer-facing business

EC approves RWE/E.On asset swap

Seven offshore wind farms set for extensions

Grimsby’s offshore wind industry highlighted